Manufacturing Sector - May 2013

Business Survey of the Manufacturing Sector in the Milan Area.

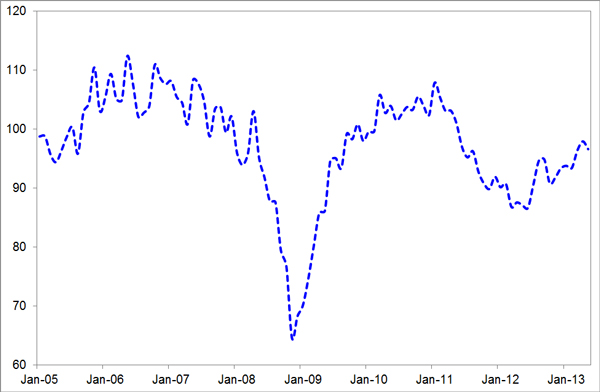

In May 2013, manufacturing confidence in the Milan area bent on the value of March 2013, even thought it remained on the highest levels of the last two years.

In detail

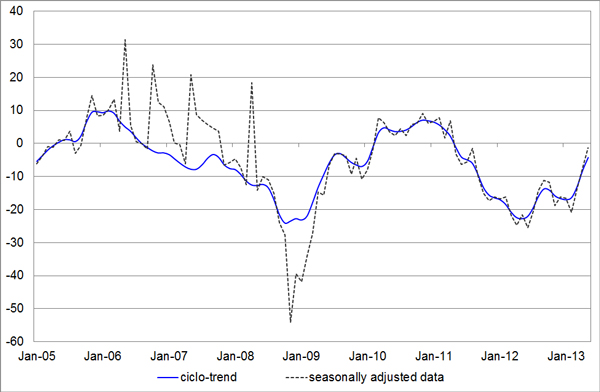

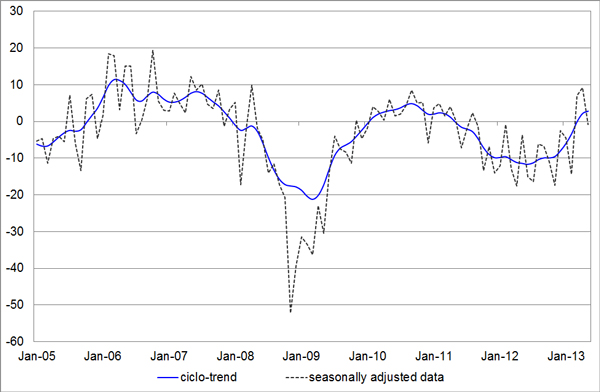

The confidence climate index moved from 97.9 in April to 96.6 in May. The contraction of the indicator was due to the reduction of foreign demand whose balance was barely negative and in small part to the decrease of the production expectation (its balance was slightly under zero). Another contribution to the loss of the index came from the balance of stocks that rose, remaining under the level considered normal for the fourth consecutive month. On the contrary, a positive share was given from the domestic demand, that advanced on the level of May 2011, although slightly negative.

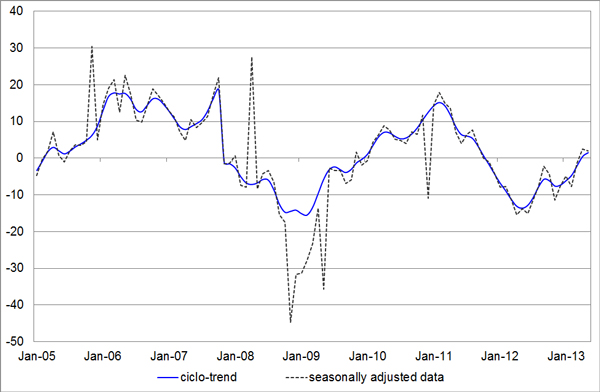

In terms of assessments, industrial production was steady. Domestic turnover improved showing a zero balance, while the foreign one lost a part of the ground conquered in April 2013. Employment went down on the negative balance of February 2013.

With reference to forecasts for the next 3-4 months, domestic orders expectations remained steady, while the foreign ones diminished, with a barely negative balance. Finally, opinions about the Italian economic situation worsened a little, strenghtened a heavily negative balance.

1. Graphs

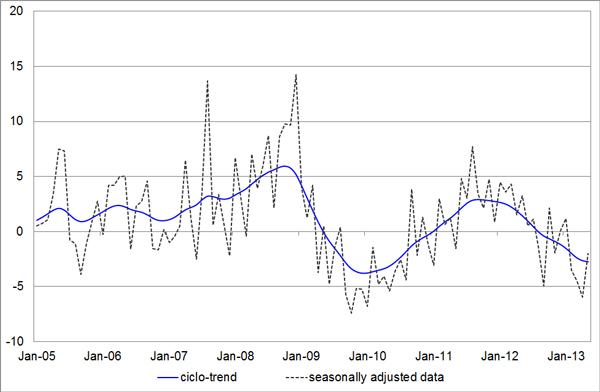

Graph 1 - Confidence climate

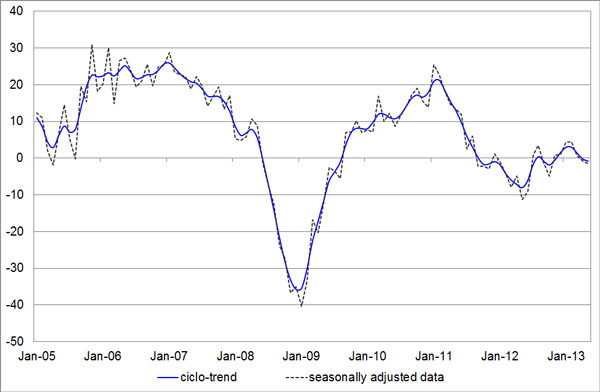

Graph 2 - Production assessment

Graph 3 - Assessment on domestic orders

Graph 4 - Assessment on foreign orders

Graph 5 - Inventories

Graph 6 - Production expectation

2. Data

Table 1 - Confidence climate1

| Reference period | Index (2005=100) |

| February-13 | 93.4 |

| March-13 | 96.3 |

| April-13 | 97.9 |

| May-13 | 96.6 |

1 The industrial confidence indicator is the arithmetic average of the seasonally adjusted data on production expectations, order books and stocks of finished products (with inverted sign). The index base is 2005=100.

Table 2 - Production

| Reference period | Assessment seasonally adj. data |

Assessment raw data |

Expectation seasonally adj. data |

Expectation |

| February-13 | -8 | 0 | 5 | 14 |

| March-13 | -1 |

11 | 1 | 6 |

| April-13 | 2 | -3 | -1 |

7 |

| May-13 | 2 |

20 | -2 | -1 |

Table 3 - Domestic orders

| Reference period | Assessment seasonally adj. data |

Assessment raw data |

Expectation seasonally adj. data |

Expectation |

| February-13 | -21 | -15 |

-3 |

4 |

| March-13 | -14 |

-11 |

-2 |

0 |

| April-13 | -7 | -9 |

-7 | -3 |

| May-13 | -1 | 11 | -7 | -6 |

Table 4 - Foreign orders

| Reference period | Assessment seasonally adj. data |

Assessment raw data |

Expectation seasonally adj. data |

Expectation |

| February-13 | -14 | -4 | 13 | 18 |

| March-13 | 7 | 10 | 14 | 17 |

| April-13 | 9 | 7 | 8 | 12 |

| May-13 | -1 | 7 | -1 | 1 |

Table 5 - Domestic turnover

| Reference period | Assessment seasonally adj. data |

Assessment raw data |

| February-13 | -26 | -11 |

| March-13 |

-4 | -2 |

| April-13 |

-4 | -8 |

| May-13 |

0 | 21 |

Table 6 - Foreign turnover

| Reference period | Assessment seasonally adj. data |

Assessment raw data |

| February-13 |

-26 | -11 |

| March-13 |

-4 | -2 |

| April-13 |

-4 | -8 |

| May-13 | 0 | 21 |

Table 7 - Other balances

| Reference period | Inventories seasonally adj. data |

Inventories raw data |

Employment seasonally adj. data |

Employment raw data |

Expectations on economic situation seasonally adj. data |

Expectations on economic situation raw data |

| February-13 | -4 | -1 | -2 | 0 | -39 | -39 |

| March-13 | -4 | -1 | 2 | 5 | -40 | -41 |

| April-13 | -6 | -6 | 2 | 3 | -33 | -33 |

| May-13 | -2 | 0 |

-2 | 0 | -36 | -35 |

Contact us

For further information please contact the Research Department tel. +390258370.328/409, e-mail stud@assolombarda.it

Non sei associato e ti servono informazioni?

ContattaciAzioni sul documento